This article will explain how to link your business income to show aggregation of business operations as discussed in Section 1.199A-4 and provide an explanatory statement.

To link multiple businesses to show your first aggregation of business operation - Individual module

- Go to your first business:

- Screen 16, Business Income (Schedule C)

- Screen 18, Rental & Royalty Income (Schedule E)

- Screen 19, Farm Income (Schedule F / Form 4835)

- Screen 20.1, Partnership Information

- Screen 20.2, S Corporation Information

- Screen 20.3, Estate and Trust Information

- Within the business activity, locate the applicable section:

- Screen 16, Qualified Business Income Deduction

- Screen 18, Qualified Business Income Deduction

- Screen 19, Qualified Business Income Deduction

- Screen 20.1, Line 20 - Other

- Screen 20.2, Line 17 - Other Information

- Screen 20.3, Line 14 - Other Information

- Enter a 1 in the following field to indicate your first aggregate business:

- Screen 16, Aggregate Tax Identification Number (code 453)

- Screen 18, Aggregate Tax Identification Number (code 450)

- Screen 19, Aggregate Tax Identification Number (code 453)

- Screen 20.1, Section 199A (20Z - 20AB) Aggregate Tax Identification Number (code 1152)

- Screen 20.2, Section 199A (17V - 17X) Aggregate Tax Identification Number (code 1152)

- Screen 20.3, Section 199A (14I) Aggregate Tax Identification Number (code 1152)

- Enter a description in the following field to explain how these businesses are allowed to be aggregated:

- Screen 16, Description of aggregated businesses and explanation of how they are allowed to be aggregated. (CTRL+E) (455)

- Screen 18, Description of aggregated businesses and explanation of how they are allowed to be aggregated. (CTRL+E) (452)

- Screen 19, Description of aggregated businesses and explanation of how they are allowed to be aggregated. (CTRL+E) (455)

- Screen 20.1, Explanation of Aggregation (code 1160)

- Screen 20.2, Explanation of Aggregation (code 1160)

- Screen 20.3, Explanation of Aggregation (code 1160)

- Repeat steps for each additional business activity to be included in Aggregate Tax Identification Number 1.

- The explanation only needs to be entered once for each aggregated business income grouping.

To create a second aggregate business grouping, repeat steps, marking as Aggregate Tax Identification Number 2.

To link multiple businesses to show your first aggregation of business operations - Fiduciary module

- Go to your first business:

- Screen 21, Business Income (Schedule C)

- Screen 23, Rent & Royalty (Schedule E)

- Screen 24, Farm (Schedule F)

- Screen 25, Passthrough K-1s

- Within the business activity locate the applicable section:

- Screen 21, Qualified Business Income Deduction

- Screen 23, Qualified Business Income Deduction

- Screen 24, Qualified Business Income Deduction

- Screen 25, Other (20)

- Enter a 1 in the following field to indicate your first aggregate business:

- Screen 21, Aggregate Tax Identification Number (code 453)

- Screen 23, Aggregate Tax Identification Number (code 453)

- Screen 24, Aggregate Tax Identification Number (code 451)

- Screen 25, Section 199A - Aggregate Tax Identification Number (code 1152)

- Enter a description in the following field to explain how these businesses are allowed to be aggregated:

- Screen 21, Description of aggregated businesses and explanation of how they are allowed to be aggregated. (CTRL+E) (455)

- Screen 23, Description of aggregated businesses and explanation of how they are allowed to be aggregated. (CTRL+E) (455)

- Screen 24, Description of aggregated businesses and explanation of how they are allowed to be aggregated. (CTRL+E) (453)

- Screen 25, Section 199A - Explanation of Aggregation (code 1160)

- Repeat steps for each additional business activity to be included in Aggregate Tax Identification Number 1.

- The explanation only needs to be entered once for each aggregated business income grouping.

To create a second aggregate business grouping, repeat steps marking as Aggregate Tax Identification Number 2.

To make the Safe Harbor Election when aggregating Rental Real Estate income - Individual and Fiduciary

When aggregating Schedule E income, and making the Safe Harbor election you'll want to avoid producing an election for each of the activities in the aggregated grouping.

- Go to the Schedule E screen.

- Individual: Screen 18, Rental & Royalty Income (Schedule E)

- Fiduciary: Screen 23, Rent & Royalty (Schedule E)

- Scroll down to the Qualified Business Income Deduction section.

- Select the box for Claiming safe harbor on rental real estate per IRS Notice 2019-07.

- This should only be selected on one of the activities in the grouping. In the left panel, select the next activity within this aggregate grouping.

- Within the Qualified Business Income Deduction section, enter a 1 in the field for Business is a qualified trade or business: 1=yes, 2=no [O].

- When you select the safe harbor election, this signifies the activity as a qualified trade or business. Marking a yes here, satisfies this requirement while preventing safe harbor election statements to be generated for every activity within the aggregate grouping.

To make an election for a second aggregate business grouping, repeat steps.

Forms view and filing the return

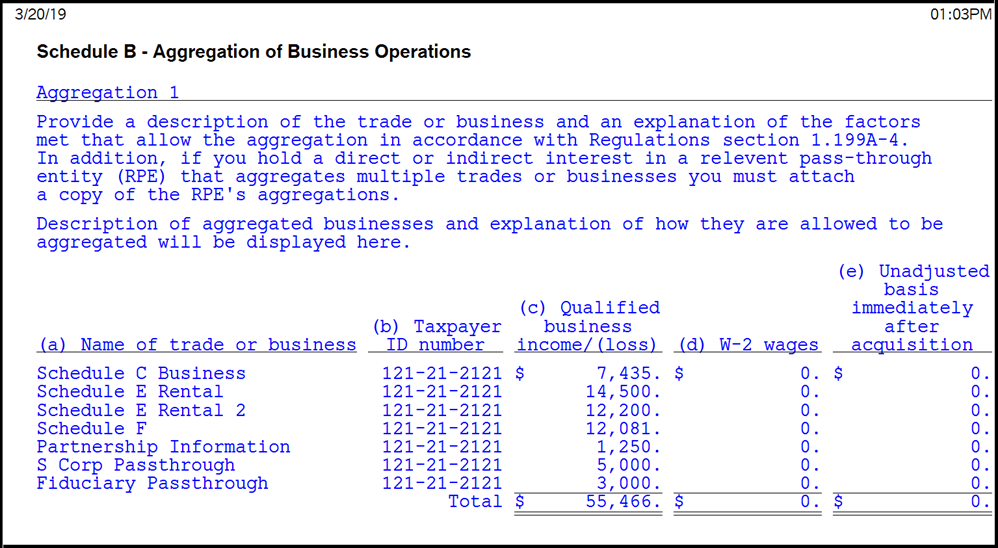

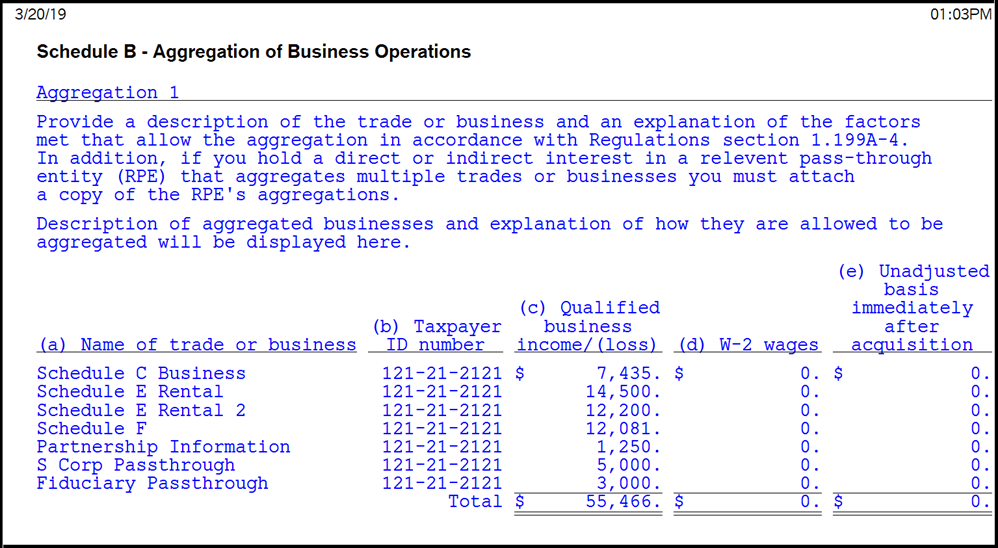

Worksheets Schedule B - Aggregation of Business Operations

Once complete, the aggregate income will be displayed in Forms view within the Worksheets. Each aggregate grouping will be listed separately. Example: Aggregation 1, Aggregation 2, etc.

The Schedule B - Aggregation of Business Operations worksheet is automatically included as a statement with the e-filing of the tax return. The Lacerte options to Auto Generate and Attach PDFs to E-Files should be set to yes for this to occur.

Follow these steps to verify this option in Lacerte

If you are on a network, you'll want to check both local and primary options.

- Go to the Settings dropdown menu.

- Select Options (network also select Primary Options).

- Select the Setup tab.

- Make sure Auto Generate and Attach PDFs to EFiles is set to Yes.

- Select OK to save and close the window.

Once the e-file has been created within the e-file wizard, the following information will be displayed on the General Information page in Forms view.

Sample image of General Information page