For tax year 2018, cooperatives with a fiscal year can receive the Domestic Production Activity Deduction (DPAD) passed through from a fiscal year 2017 cooperative, as well as the DPAD passed through from a fiscal year 2018 cooperative.

These two amounts are reported differently on Form 1040. Because of this, Lacerte includes two different input fields for these items within the Schedule C activity and Schedule F activity input screens.

Click the applicable screen below for more information.

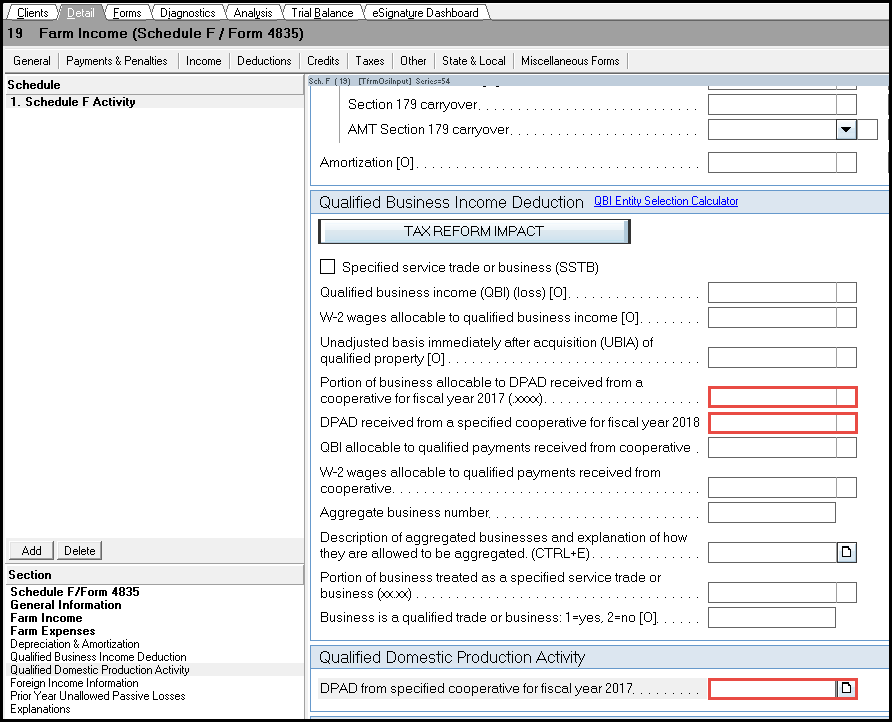

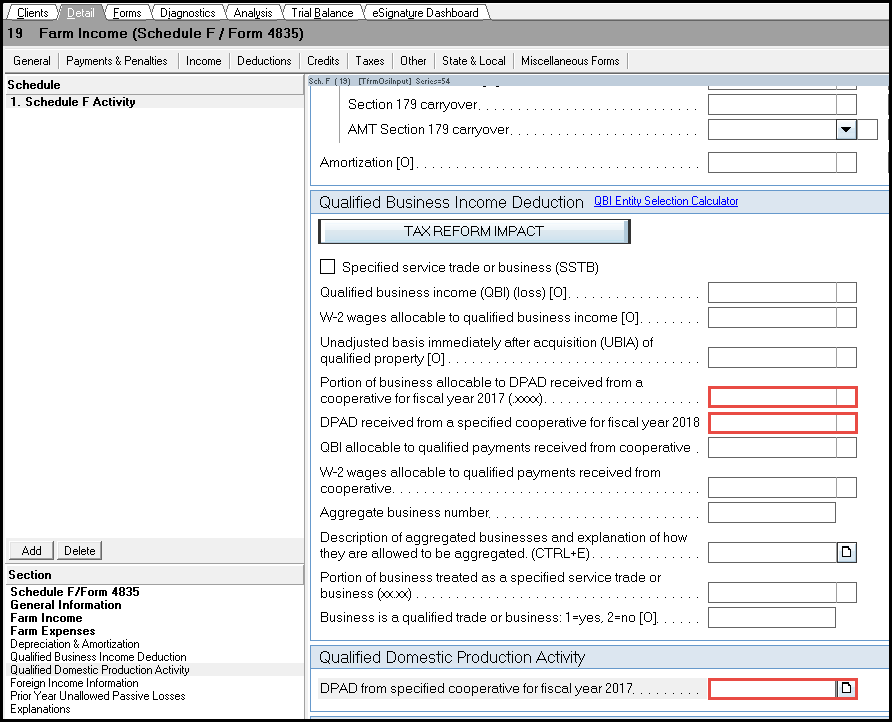

Screen 19, Farm Income (Schedule F/Form 4835) details

- DPAD from specified cooperative for fiscal year 2017 (code 454) - This amount will flow to Form 8903, line 23 to be included in the total on line 25. This amount then flows to Schedule 1, line 36 along with a statement which indicates "DPAD - Form 8903."

- Portion of business allocable to DPAD received from a cooperative for fiscal year 2017 (xx.xx) (code 513) - Because the income allocable to the fiscal year 2017 cooperative isn't eligible for QBI, this field can be used to indicate the percentage of the Schedule F income allocable to the fiscal year 2017 DPAD. The program will reduce your QBI by this percentage.

- Other methods can be used to divide this amount up. If you choose to use a method other than this field, the Qualified business income (QBI) (loss) [O] (code 445) must be used, and a supporting statement can be created using Screen 47, Notes.

- DPAD received from a specified cooperative for fiscal year 2018 (code 315) - This amount will flow to the QBI worksheet. From there, it'll flow to Form 1040, line 10 with a statement which indicates "DPAD 199A(g)."

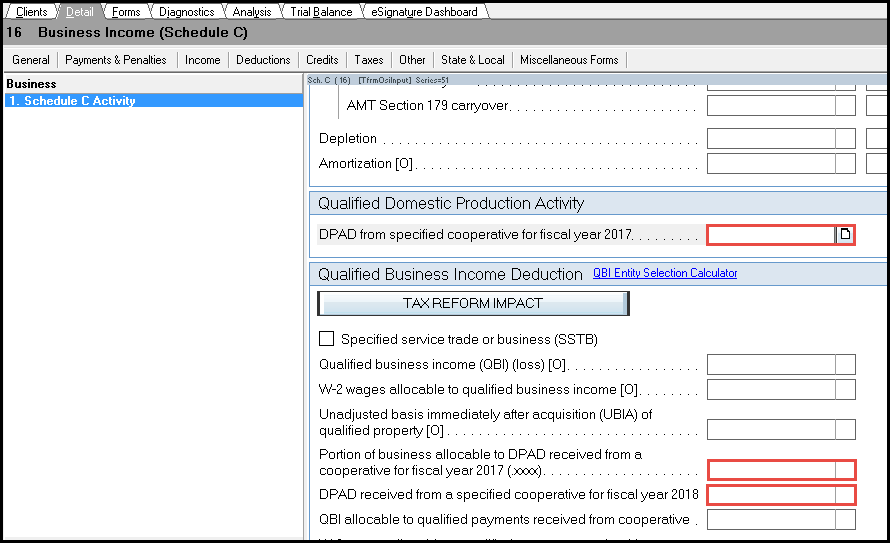

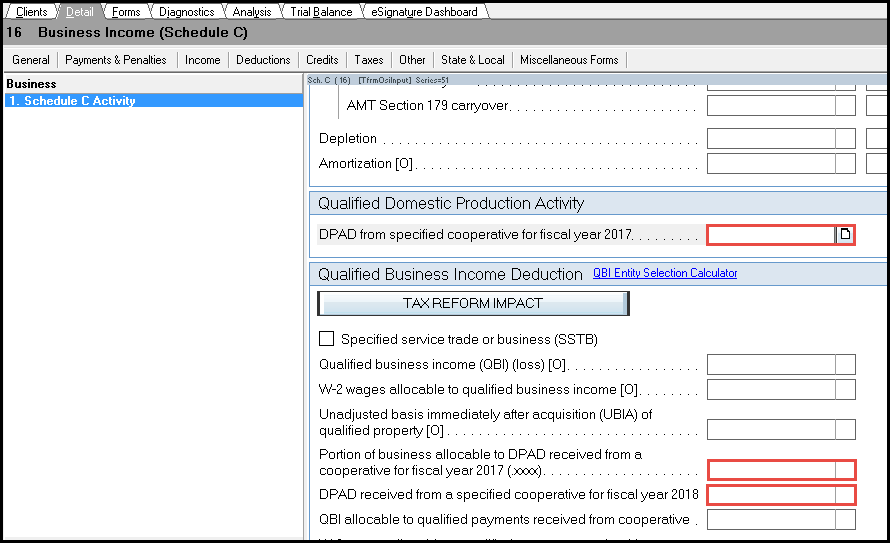

Screen 16, Business Income (Schedule C) details

- DPAD from specified cooperative for fiscal year 2017 (code 456) - This amount will flow to Form 8903, line 23 to be included in the total on line 25. This amount then flows to Schedule 1, line 36 along with a statement which indicates "DPAD - Form 8903."

- Portion of business allocable to DPAD received from a cooperative for fiscal year 2017 (xx.xx) (code 513) - Because the income allocable to the fiscal year 2017 cooperative isn't eligible for QBI, this field can be used to indicate the percentage of the Schedule C income allocable to the fiscal year 2017 DPAD. The program will reduce your QBI by this percentage.

- Other methods can be used to divide this amount up. If you choose to use a method other than this field, the Qualified business income (QBI) (loss) [O] (code 445) must be used, and a supporting statement can be created using Screen 47, Notes.

- DPAD received from a specified cooperative for fiscal year 2018 (code 315) - This amount will flow to the QBI worksheet. From there, it'll flow to Form 1040, line 10 with a statement which indicates "DPAD 199A(g)."

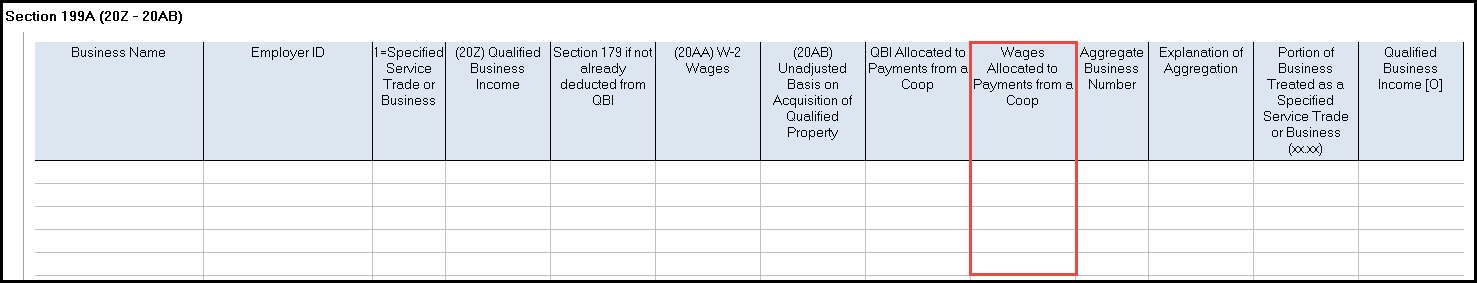

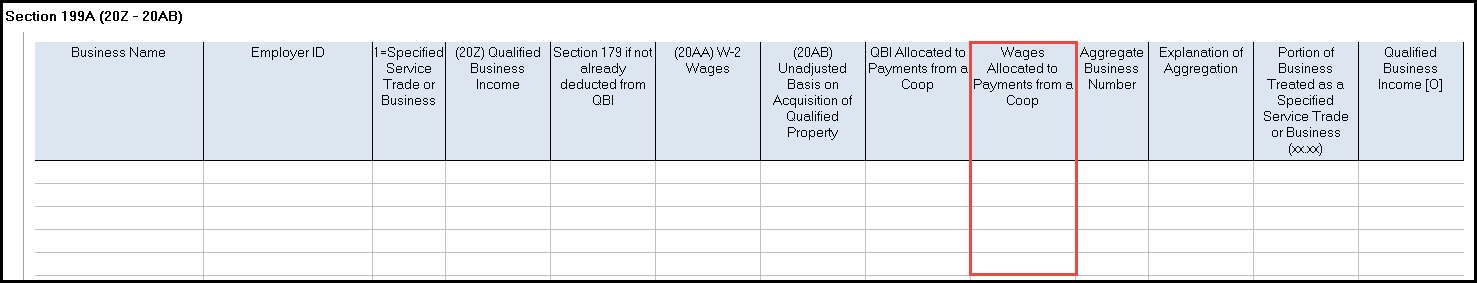

Screen 20.1, Partnership Information details

Line 20 - Other - Section 199A (20Z - 20AB):

- (13W) DPAD received from specified cooperative (code 1164)

- (20AH) DPAD received from a specified cooperative (199A(g)(2)) (code 1165)

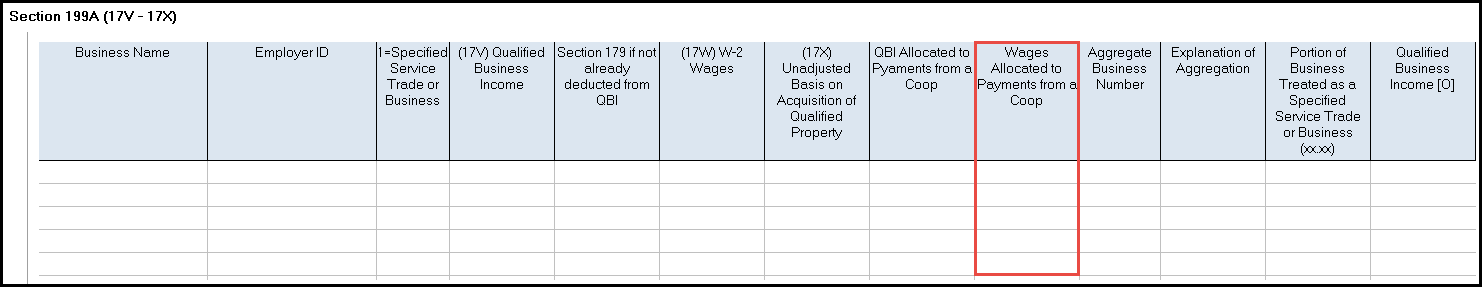

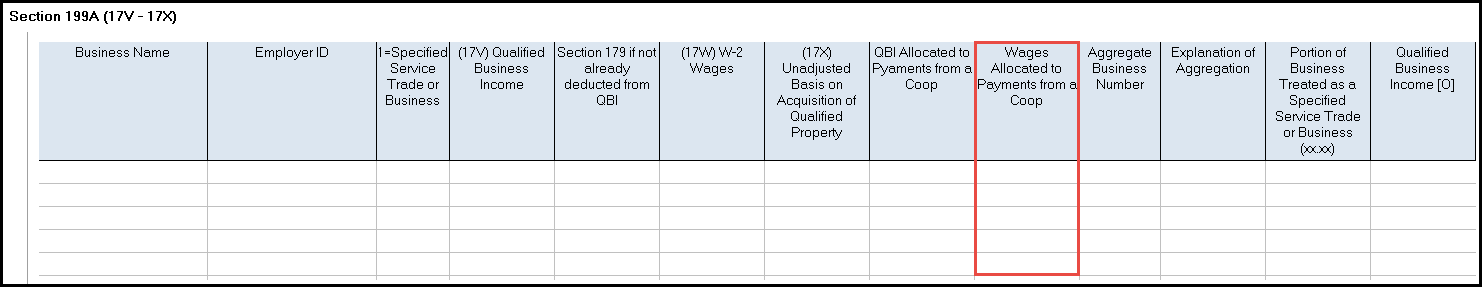

Screen 20.2, S Corporation Information details

Line 17 - Other Information - Section 199A (17V - 17X):

- (12S) DPAD received from a specified cooperative (code 1164)

- (17AC) DPAD received from a specified cooperative (199A(g)(2)) (code 1165)

Resources

Related topics