Before you start:

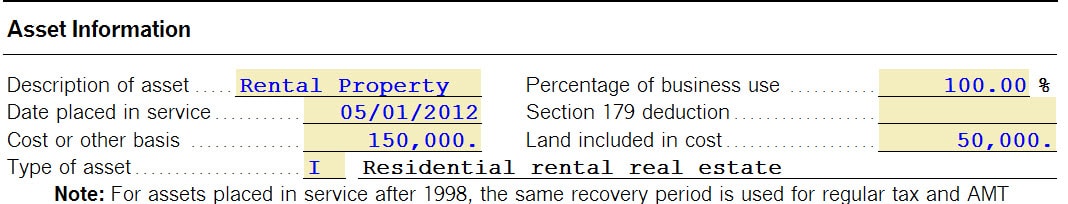

- ProSeries uses Asset Entry Worksheets to enter, and track regular depreciation, special depreciation, bonus depreciation and Section 179 taken.

- Each depreciable asset should be entered on a separate Asset Entry Worksheet.

- In the 1040 return vehicles should not be entered on the Asset Entry Worksheet. See the Completing the Car and Truck Expenses Worksheet in ProSeries for vehicle depreciation.

Creating an asset entry worksheet:

- Open the client return.

- Press F6 bring up the Open Forms.

- Type DEE to highlight Depr Entry Wks and click OK.

- To create a new asset under Create new copy enter the description of the asset and click Next.

- Under Activity Type select the type of business the asset is used for and click Next.

- If the business activity is one that supports multiple copies (such as the Schedule C or 8825), select the Existing Schedule/Form that the asset is used for and click Finish.

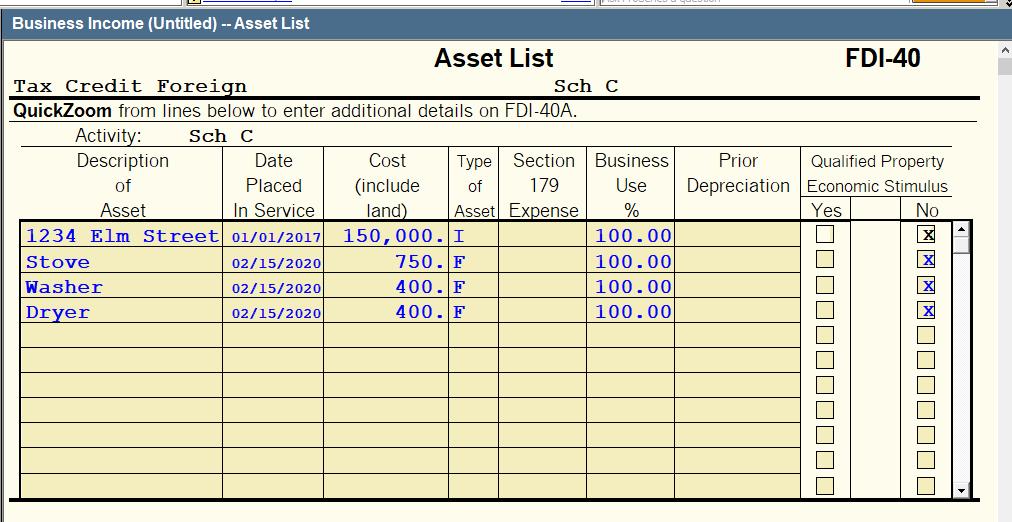

Entering asset entry worksheets using Quick Entry Mode:

If you are entering multiple assets in ProSeries Professional you can use Quick Entry Mode to enter the assets into a grid for faster data entry for Form 1040, 1120, 1120S and 1065. This feature is not available in ProSeries Basic.

Entering prior year data for a new client:

When you have a new client you are entering into ProSeries that client may have depreciation from prior tax returns. This section will help you enter that prior year information so ProSeries can continue tracking the depreciation going forward:

Entering disposition information for a depreciable asset:

These sections will help you complete the disposition section of the Asset Entry Worksheet. Click on a topic below to see more: