![]() Lacerte Tax Import is only available for the current tax year and is available until November when it's taken offline to prepare for the next tax season. It's brought online in mid-January for processing current year returns.

Lacerte Tax Import is only available for the current tax year and is available until November when it's taken offline to prepare for the next tax season. It's brought online in mid-January for processing current year returns.

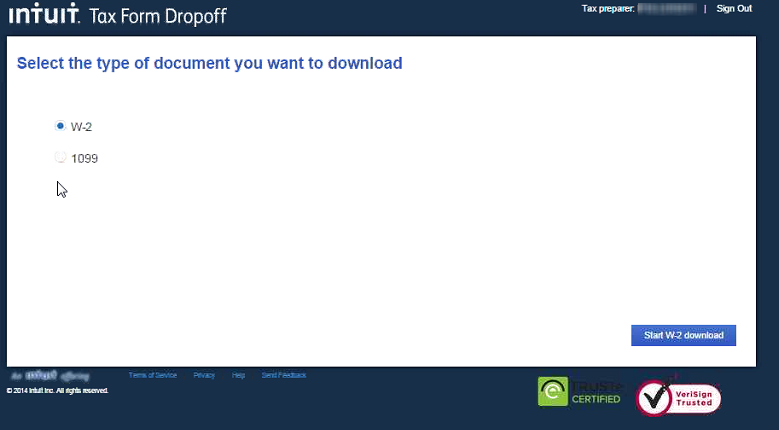

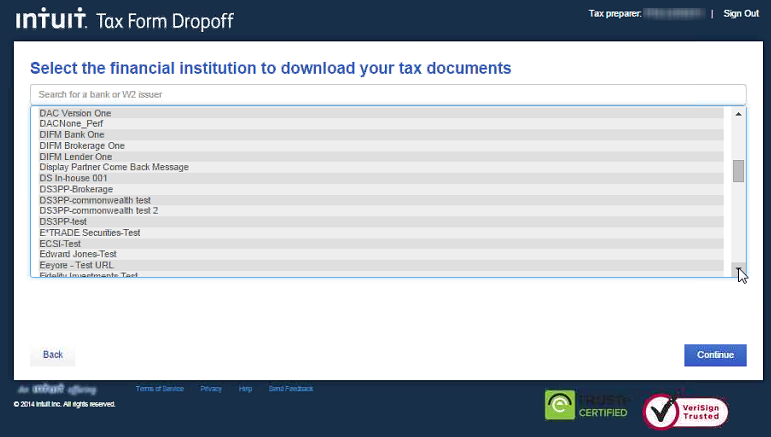

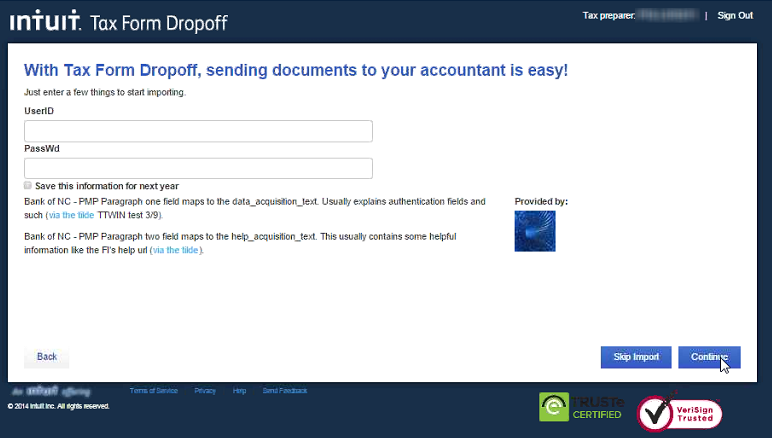

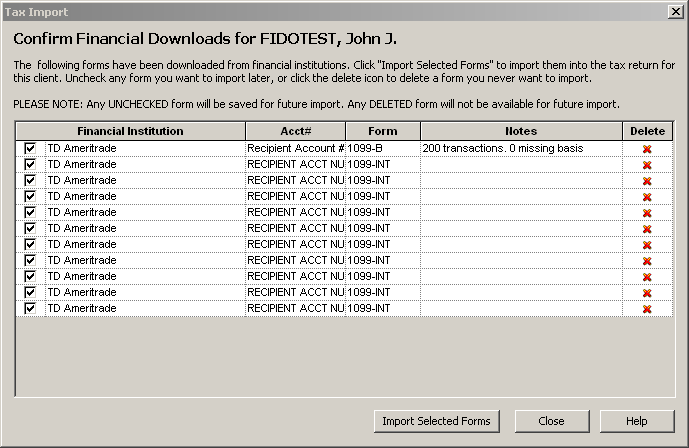

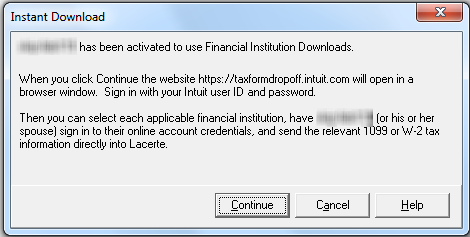

Lacerte Tax Import allows you to quickly and accurately download W-2, 1098 and 1099 forms directly into the 1040 return. There are two ways to download financial institution data from your client's accounts.

Review the steps below or watch our short video to learn more.

![]() If the taxpayer has enabled extra security on their financial institution, (such as two factor authentication) Tax Import won't be able to connect. This will generate an error: A popup blocker prevented us from connecting to your bank. Turn off your popup blocker, then try again.

If the taxpayer has enabled extra security on their financial institution, (such as two factor authentication) Tax Import won't be able to connect. This will generate an error: A popup blocker prevented us from connecting to your bank. Turn off your popup blocker, then try again.