Every year, the IRS releases tax forms on a rolling basis. Forms and schedules can sometimes be delayed and may not be final or ready to file. Update your ProSeries software regularly to ensure you have the latest release and forms, and check the schedule to learn when forms will be available.

![]() When viewing the release dates please be aware that updates can be released at any point during the day but are typically released in the afternoon.

When viewing the release dates please be aware that updates can be released at any point during the day but are typically released in the afternoon.

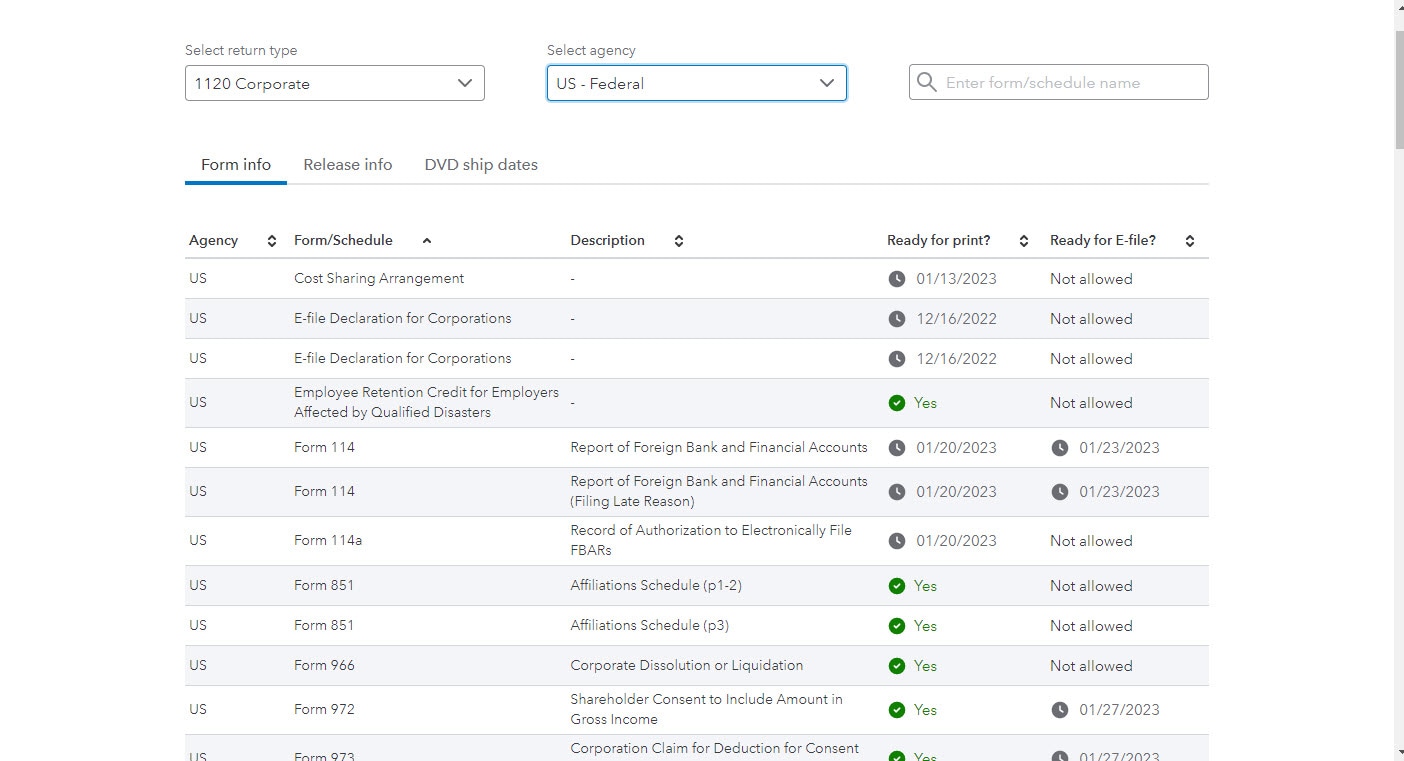

Follow these steps to find out when forms are available:

- Open the ProSeries Tax form finder link.

- From the drop down menus at the top Select return type, then Select agency.

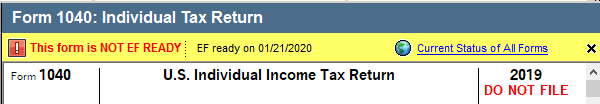

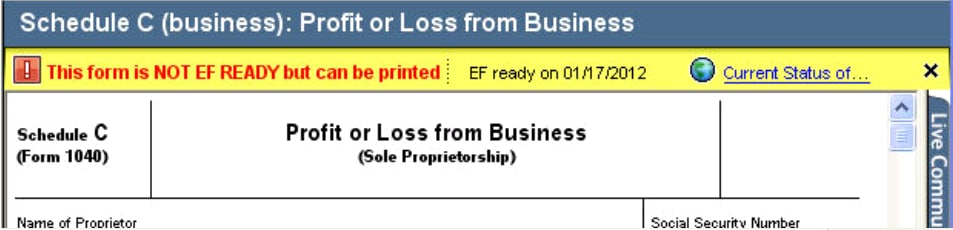

Follow these steps to find a form's release date in ProSeries:

- Open a client file.

- Select either a federal or state return.

- Press the F6 to bring up Open Forms.

- Select the federal or state form in question and click OK.

- View the form's status bar to find all current information about the form.

![]() Update your program regularly to make sure that you have the latest release and forms.

Update your program regularly to make sure that you have the latest release and forms.

Finding important state and federal for dates in ProSeries

To find out when the government will release the final version of forms and form instructions, visit the taxing authority's website. Usually, the governing tax authority must approve a form before the final version of the form appears in tax preparation software.