Before you start:

- To e-file any return in ProSeries, you'll need an approved Electronic Filing Identification Number (EFIN) from the IRS.

- See How do I obtain an EFIN from the IRS?

- If you don't have an EFIN this process can take up to 45 days.

- To e-file any return in ProSeries your EFIN must be registered with Intuit.

- See Register your EFIN with Intuit before e-filing.

- The registration process takes about two business days.

- E-file is available for three tax years. Currently, you can e-file from ProSeries 2023, 2022 and 2021.

Table of contents:

Setting up ProSeries for e-file:

- When you first install ProSeries, the ProSeries Practice Setup wizard will pop-up.

- If you closed the pop-up and need to open it again from the Help menu, select Option Setup Wizard.

- On the Firm & Preparer Info tab, enter any applicable Firm Level Information first.

- Employer ID# (EIN)

- Phone number

- Fax Number

- Firm Email.

- Electronic Filing Identification # (EFIN)

- E-file Contact Name.

- Under the Firm information, you must enter at least one preparer, but you can enter as many as you need by selecting the + Add A New Preparer button. This includes:

- A Preparer Code. This is any 1-3 numbers or letters of your choice that the preparer can enter on the tax return to tell ProSeries who prepared this return. A lot of firms use the preparers initials.

- If e-filing in New York enter your NY Tax Preparer Registration # or NY Exclusion Code. See Entering an NY tax preparer registration number or exclusion code in ProSeries for details.

- Preparer Name as you wish it to be shown on the tax returns.

- Social Security Number although the federal and most state returns will allow a PTIN to be used instead of the SSN some states still require this for e-file.

- Preparer Tax ID Number (PTIN) is obtained from the IRS. See PTIN Requirements for Tax Return Preparers if you need to apply for one.

- CAF# if applicable. This number is not required for the general preparation and filing of taxes. See 2848 instructions for details about the CAF#.

- Preparer Email.

- Preparer Phone Number.

- ERO Practitioner PIN is any 5 digits of your choice to be the electronic signature on the tax return.

- State ID# for NM and OR firms only.

- Once all the preparers are entered, select Next to continue to the ERO Information.

- The ERO Information screen is used to make sure the contact information associated with the EFIN. ERO stands for Electronic Return Originator. Most of the information will flow from your license information. Make sure the information is correct and select Next to continue through the ProSeries Practice Setup.

Preparing and e-filing the tax return:

- Open the return to the Federal Information Worksheet.

- Scroll down to the Electronic Filing of Tax Return Information section.

- For individual returns, this is Part VI.

- Check the box to File federal return electronically.

- If you need to e-file any state returns, check the File state or city returns electronically box as well.

- Complete the tax return as normal.

- If the taxpayer wants direct deposit or electronic funds withdrawal, check to make sure that is entered on the Information Worksheet.

- Run Final Review on both the federal and state return to correct any errors that say You must fix this error.

- You must fix this error will prevent the return from being e-filed.

- Have the taxpayer sign any required signature documents, such as the 8879 or 8878.

- Once you're ready to e-file go to the E-File menu and select Transmit Returns/Extensions/Payments.

- Check the federal and/or state returns you need to e-file today and select OK.

- Review the Electronic Filing Transmission warning. Once you have read the warning, select Yes to continue.

- ProSeries will now convert the return into the IRS readable format and transmit the converted data to the IRS.

- Review the electronic filing log to make sure the conversion and transmission were successful. If you received the green thumbs-up, you have successfully e-filed the return.

To select multiple individual state tax returns for electronic filing:

- Check the box to File the state(s) electronically.

- In the table, you can enter the first four states by clicking the dropdown and selecting the state.

- After selecting the 4th state to be filed electronically, use the down arrow key to get to the next row.

What happens after transmitting the return?

Once you transmit the return, it's forwarded through the Intuit Electronic Filing Center to the IRS and/or agency. Once the agency accepts or rejects the return, the acknowledgements will be available for pickup in ProSeries.

- Federal return acknowledgements are usually available within one to three days.

- State return acknowledgements are usually available within two to five business days.

- BSA acknowledgments (for Form 114) are usually available within two to five business days.

How to check for acknowledgements in ProSeries:

From the E-File menu, select Electronic Filing, then Receive Acknowledgement Statuses.

For more details on acknowledgements, see Checking the acknowledgment status of an e-filed return.

Why are the advanced E-File menu and EF Now buttons unavailable when on the EF Center?

When in the EF Center, the following are unavailable:

- The EF Now button

- The Convert/Transmit Returns and Extensions item in the E-File menu

The HomeBase must be configured to use the Details view configuration—not the List view configuration—to activate EF Now button and the advanced E-File menu.

Before you start:

- This article references default installation paths and uses YY to reference the tax year in 20YY format. C: will always indicate the local drive and X: will always indicate the network drive.

Follow these steps to change the HomeBase view configuration:

- Open ProSeries.

- From the HomeBase menu, select the Details to place a check next it.

- Check if the EF Now button or E-File menu is available now.

If the menu items are still unavailable and the HomeBase is set to use the Details view configuration, then proceed with the steps below to repair the ProSeries installation.

Follow these steps to repair the ProSeries installation:

- Close ProSeries.

- Open Windows File Explorer.

- Browse to the location where ProSeries is installed. The default installation paths are:

- C:\ProWinYY for ProSeries Professional.

- C:\BasWinYY for ProSeries Basic.

![]() If you're on a network installation of ProSeries, you must install the admin workstation using the download from the website. Also, you must install from the WKSTN folder in the ProNetYY folder on your network for all user workstations.

If you're on a network installation of ProSeries, you must install the admin workstation using the download from the website. Also, you must install from the WKSTN folder in the ProNetYY folder on your network for all user workstations.

- Right click on the 32bit folder and chose Rename.

- Rename the file to 32bitOld.

- Close File Explorer.

- Download and install ProSeries again to repair the current installation.

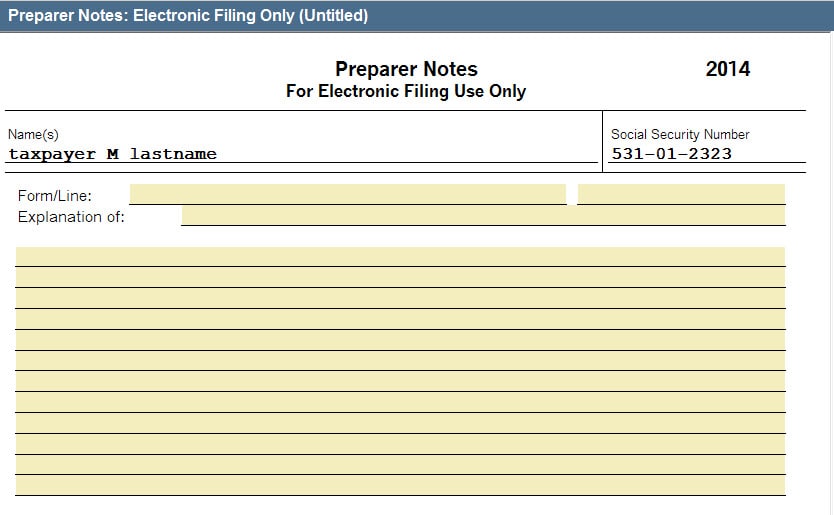

Are supporting statements e-filed with Form 1040?

No, the supporting statements or itemizations created for a line in the tax return aren't electronically filed with the return.

If additional information needs to be sent in the electronic return, complete the Preparer Notes form. Only the supporting information entered on the Preparer Notes will be electronically filed with the return.

![]() You can attach a PDF file to a 1040 e-file return. Refer to this article for more information.

You can attach a PDF file to a 1040 e-file return. Refer to this article for more information.

How do I add Preparer Notes to a return?

![]() Preparer Notes aren't available for business returns. You can attach a PDF file to a e-file business return instead. PDF attachments are also available for individual returns. Refer to this article for more information.

Preparer Notes aren't available for business returns. You can attach a PDF file to a e-file business return instead. PDF attachments are also available for individual returns. Refer to this article for more information.

Follow these steps to access Preparer Notes:

- Press F6 to bring up Open Forms.

- Type PN to highlight Preparer Notes.

- Press Enter to open Preparer Notes.

- Create the Preparer Note and enter the required information.

- Additional Preparer Notes can be created as needed.

- Preparer Notes are for e-file only.

Why is the Convert/Transmit Returns menu option unavailable when e-filing?

When attempting to e-file clients, the Convert/Transmit Returns menu option is unavailable. There may also be no grid lines or column headings in the program.

Follow these steps to resolve this issue:

- Go to HomeBase.

- From the HomeBase menu, select Details.

- From the E-File menu, select Electronic Filing to make sure the menu option is now available.

Follow these steps if the above steps don't work:

- Close ProSeries.

- Open File Explorer.

- Browse to the location where ProSeries is installed:

- The default location is C:\BasWinYY for ProSeries Basic or C:\ProWinYY for ProSeries Professional. YY represents the two-digit tax year.

- Right-click on the ProWinYY or BasWinYY folder and chose Rename

- Type the word old at the end of the name

- For example, BasWinXXold or ProWinYYold.

- Close File Explorer.

- Reinstall ProSeries from the latest download (or CD release).