This article will help you:

- determine which estimates can be e-filed separately from the tax return,

- verify the electronic payment date, and

- transmit estimated tax payments.

Follow these steps to e-file estimated tax payments:

- Go to the Client list.

- Highlight the client(s) whose estimates you want to send.

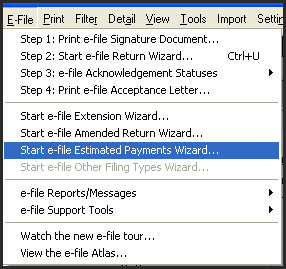

- From the E-File menu, select Start e-file Estimated Payments Wizard.

- If you receive a message that the "Client has no estimated payments that can be e-filed", the client may be able to set up estimates with the filing of their return, but can't transmit them separately. See Which estimates can I e-file? below.

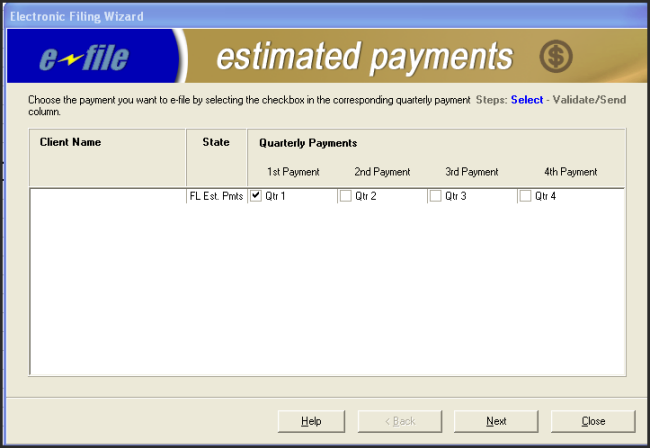

- Under Quarterly Payments, select the payments you wish to transmit, and click Next.

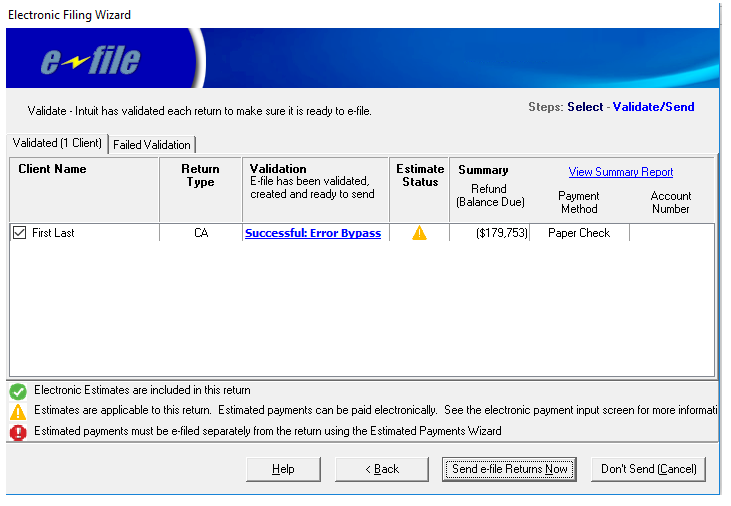

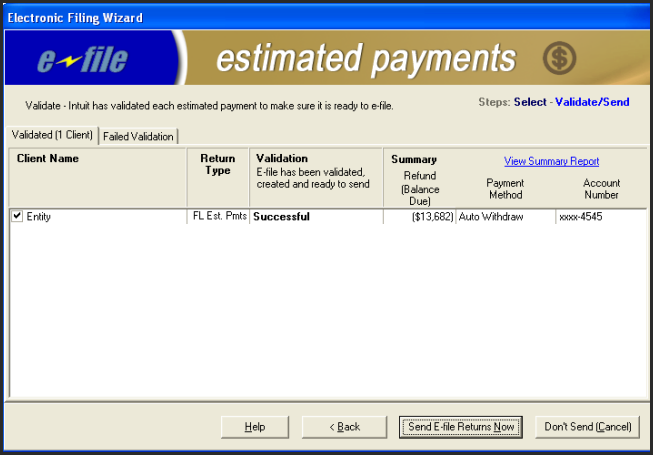

- Lacerte will check the payments for missing or incorrect information. If successful, the Summary will provide the details of the payment.

- Click Send E-file Returns Now to transmit the estimates.

If the validation found errors, you will see Error: Diagnostics under Validation. Click on the link to see the errors. Once corrected, follow the steps again to validate again.

To see details of the transmission, you can click View Summary Report. This will only be available if the validation was successful.