After-the-fact payroll checks are:

- Payroll checks that have already been issued.

- Need to be recorded accurately for accounting records and payroll reports.

There are two methods for entering after-the-fact payroll in Write-Up. Both are done through the Enter Transactions screen.

After-the-fact payroll entry in write up:

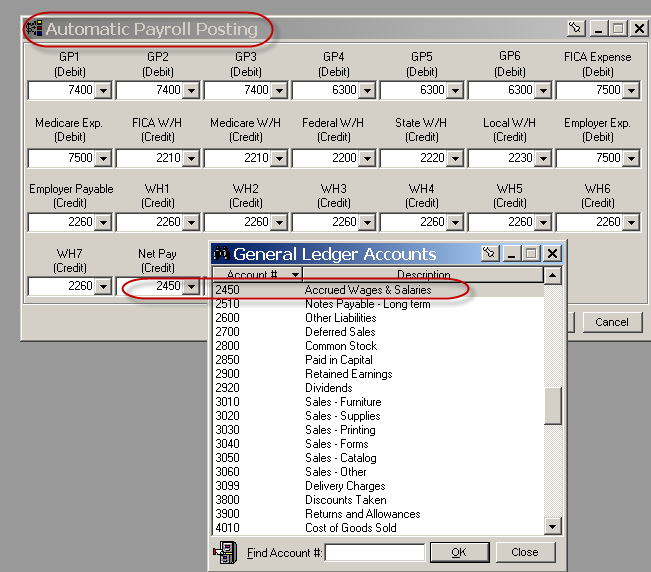

The Net Pay Account is designated differently depending on which method is used for that paycheck, therefore enter the appropriate account number in the Net Pay field.

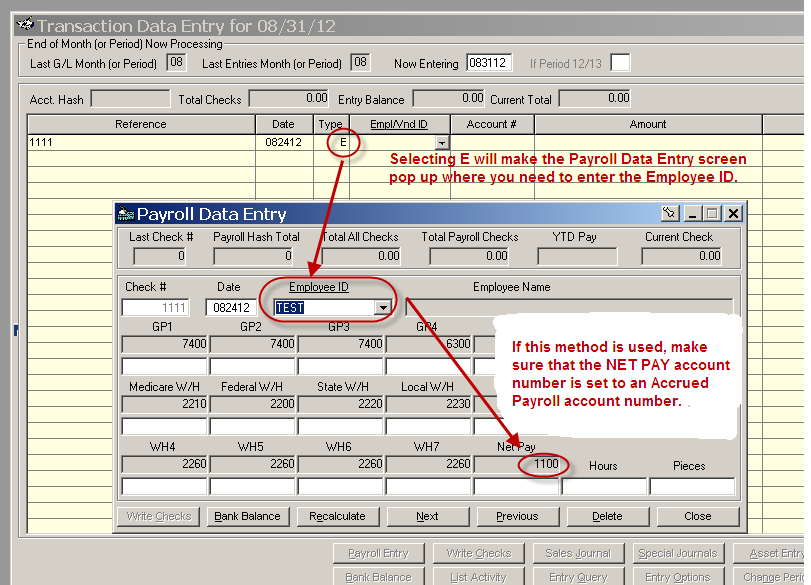

The E-Method:

Checks written this way are displayed on the Transaction Data Entry screen with all of the regular transactions and will be included in Transaction Listing reports:

- Enter the checks directly on the Transaction Data Entry screen.

- Enter E in the E/V field after entering the check number and the date.

- This lets the system know you are writing an Employee check and pulls up the Payroll Data Entry screen.

- The Net Pay account on the Automatic Payroll Posting screen should be an accrued liability account.

- This is due to the way the cash disbursement entry is made as a credit to the default bank account.

- If the cash account is assigned for Net Pay with the E-method, then the Cash Account will be credited twice: once as a credit on the Net Pay account assignment, and again as the Cash Disbursement credit to the default bank account.

- E-method checks must specify an Accrued Payroll account for the background posting to correctly assign debits and credits.

- This method is used when payroll checks and regular transaction checks are written from the same bank account.

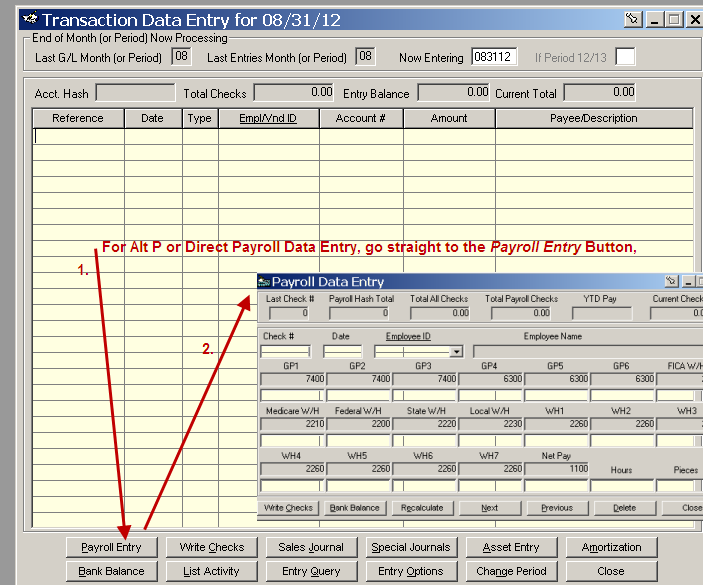

The ALT-P Method:

Checks written this way aren't displayed on the Transaction Data Entry screen as a line item along with other transactions.

- The paychecks are kept in a separate payroll journal.

- To enter them, press ALT-P, or go directly to the Payroll Data Entry button from the Transaction Data Entry screen without entering anything on the transaction line.

- The Net Pay account on the Automatic Payroll Posting screen for checks written using this method must be a Cash account.

- This method is often used when payroll checks are written from a separate bank account than the regular transaction checks.

The method you select is your preference. However, you should consistently use one method or the other, or change the Net Pay account to the correct account depending on which method is being used.

Transactions are posted by printing a General Ledger and Payroll Journal, or setting the Automatic Posting feature in the Company Wizard.

After-the-fact payroll entry in batch payroll:

- After-the-fact check recording can also be done in the Batch Payroll module by using the Manual Processing input screen.

- This method is the same as the Alt-P method in Write Up; it's simply accessed through the Batch Payroll module (it's the same Payroll Data Entry screen).

- The Net Pay account on the Automatic Payroll Posting screen for checks written using this method must also be a Cash account.

- Transactions are kept in the Payroll Journal, posted by Printing the Payroll Journal or setting the automatic posting feature in the Company Wizard.

- Transactions may be revisited at a later date by accessing either the Payroll Data Entry through the Write Up Transaction Entry screen or the Batch Payroll Manual Processing screen.

- Changes, additions or deletions can be made in either area.

- Posting the payroll journal updates the Employee Earnings Records regardless of the screen used to enter.