Before you start:

- This article applies to ProSeries Professional only.

- Starting in tax year 2022, ProSeries Professional is 64-bit software, meaning that it will no longer work with 32-bit email clients.

This article will help you:

- Learn how to email your clients a password protected (encrypted) PDF file of their tax returns

- Know what to tell your clients so they can access their returns

- Understand how to check if your email application is supported

Table of contents:

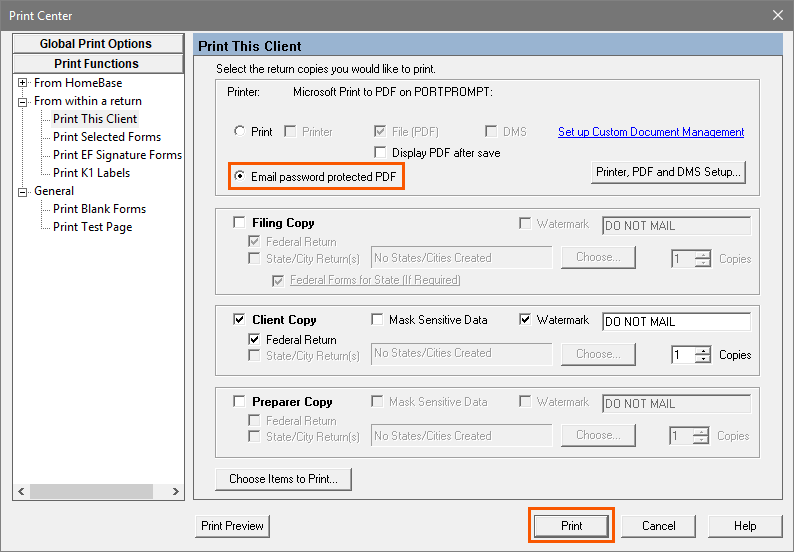

How to send a password protected PDF version of your client's tax return:

- Open the taxpayer's return in ProSeries Professional.

- From the File menu, select Print.

- Under Printer: select Email password protected PDF.

- Choose the Filing Copy, Client Copy, or Preparer Copy.

- Click Print.

- Click Save to save the PDF file.

- Select Attach the PDF to the email and click OK.

You can also select Upload the PDF and email a link. This option allows the taxpayer to access their email without having to store the Attached PDF in their email. Documents uploaded using the Intuit Cloud Service will remain available for taxpayers to access using a link in the email until December 31st of the current tax year.

You can also select Upload the PDF and email a link. This option allows the taxpayer to access their email without having to store the Attached PDF in their email. Documents uploaded using the Intuit Cloud Service will remain available for taxpayers to access using a link in the email until December 31st of the current tax year. - You can review and modify the email in the Email Preview screen and then click the E-Mail to send the email with the attached encrypted PDF to your client. The items you selected to be included in the PDF will be emailed to the taxpayer's email address entered on the Federal Information Worksheet in the federal tax return.

- Changes to the email template can be saved for all clients by clicking Save for All Clients. The email template can be reset by selecting the Restore Default Text. Click Preview PDF to preview the PDF that will be attached to the taxpayer's email.

- On the ProSeries Printing Message Log select Close.

When you are finished, a copy of the password-protected PDF that is emailed will be copied to the ProPDF folder on your computer's hard drive under the corresponding tax year in a folder named Emailed. The default location will be C:\ProPDF\TY2023\Emailed for ProSeries Professional 2023.

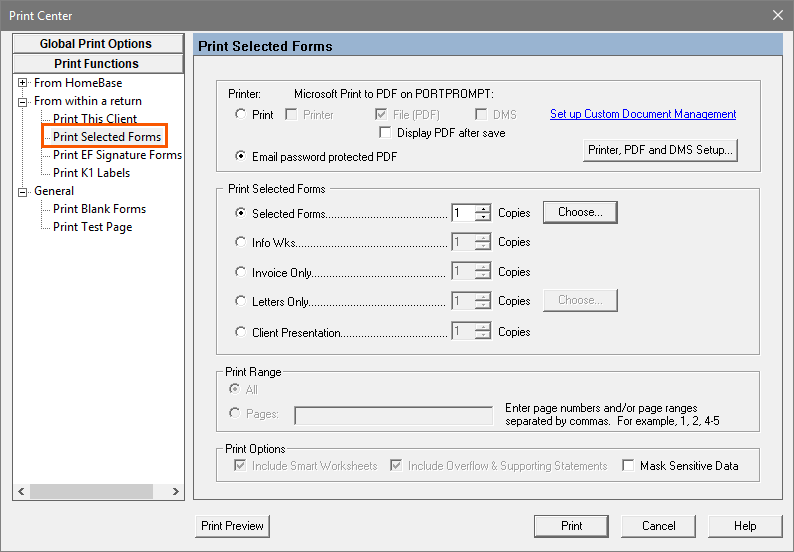

How to send a password protected PDF version of only specific forms:

- Open the taxpayer's return in ProSeries Professional.

- From the File menu, select Print.

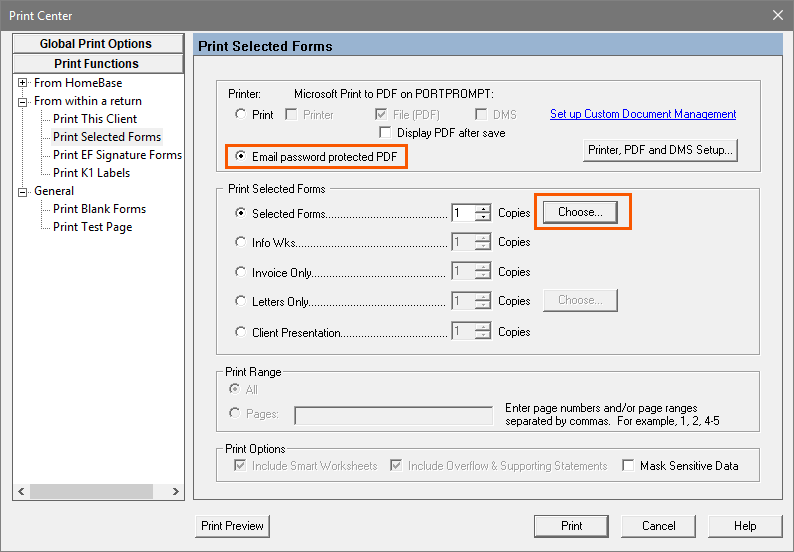

- On the left side under Print Functions select Print Selected Forms.

- Under Printer: select Email password protected PDF.

- Under Print Selected Forms use the Choose button to pick the forms from the return you want to include.

- Click Print.

- Click Save to save the PDF file.

- You can review and modify the email in the Email Preview screen and then click the E-Mail to send the email with the attached encrypted PDF to your client. The items you selected to be included in the PDF will be emailed to the taxpayer's email address entered on the Federal Information Worksheet in the federal tax return.

- Changes to the email template can be saved for all clients by clicking Save for All Clients. The email template can be reset by selecting the Restore Default Text. Click Preview PDF to preview the PDF that will be attached to the taxpayer's email.

- On the ProSeries Printing Message Log select Close.

When you are finished, a copy of the password-protected PDF that is emailed will be copied to the ProPDF folder on your computer's hard drive under the corresponding tax year in a folder named Emailed. The default location will be C:\ProPDF\TY2023\Emailed for ProSeries Professional 2023.

How will my client access their tax returns sent by encrypted email?

The email will be delivered to the taxpayer using the preparer's email address entered in the ProSeries Options under Firm/Preparer Information.

The encrypted PDF file will be created with an automatically generated password based on information in the tax return. The email the taxpayer receives will contain instructions explaining how to determine what the password is to open the encrypted PDF attachment. The password cannot be set manually, so taxpayers will need to read these instructions to view the return.

Do I have the right email application installed?

- Supported Email Applications:

- All 32-bit versions of Outlook 2007 or later

- Thunderbird (Desktop only)

- Unsupported Email Applications:

- All 64-bit versions of Outlook, Outlook Express, and Windows Mail

- All web-based versions of Outlook, Outlook Express or Windows Mail

- All webmail services (such as Outlook.com, Outlook 365, Gmail, Yahoo, AOL, etc.)

Not sure if your version of Outlook is 32-bit or 64-bit? Click here for instructions on how to check.

If you are using a webmail service, you may be able to configure it for access through the MAPI email client installed in Windows. Our support agents cannot assist with setup of your email application. Please contact your local IT professional for further assistance, and let them know that you ll need a 32-bit, ExtendedMAPI-Compliant email client application to use this feature in ProSeries Professional. SimpleMAPI-compliant email clients may not function correctly.

How do I change the email client used by the program?

ProSeries uses the default email client configured in the Windows Operating System. The email client must be Extended MAPI compliant program for compatibility. See How To Change Default Email Client, or contact a local IT professional, for more information on changing Windows default programs.

In ProSeries 2018 and newer, how do I use 64-bit versions of Outlook?

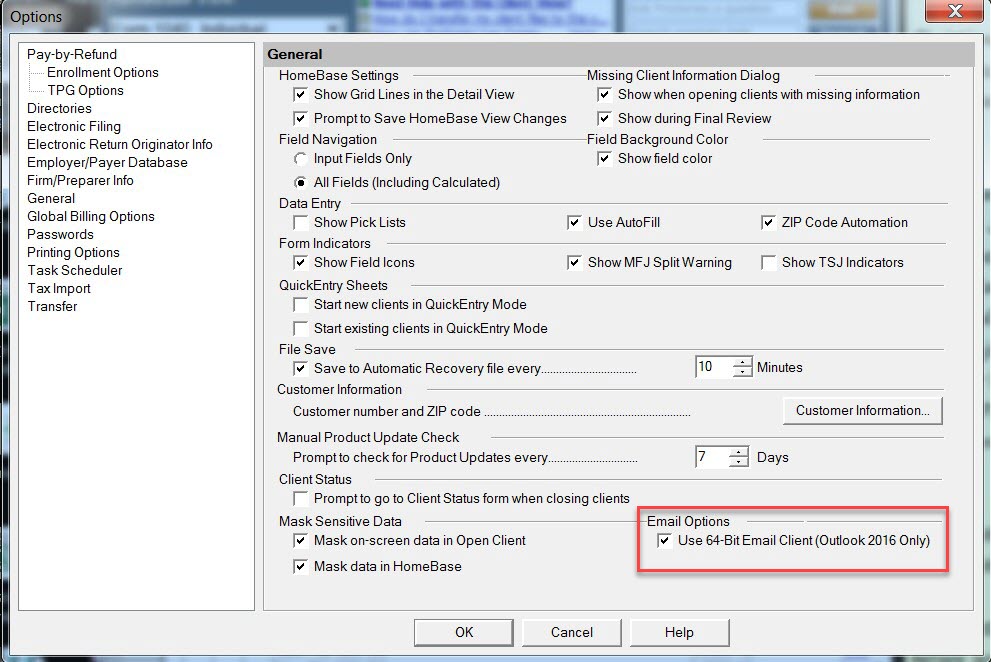

Starting with ProSeries 2018, you can use the program with 32-bit or 64-bit email clients. To configure ProSeries:

- From the Tools menu, select Options.

- Mark the checkbox labeled User 64-bit E-mail Client (Outlook 2016 Only).