Table of contents:

In tax year 2014, we renamed the required service components of your tax software purchase and presented them as a standalone line item on your invoice called Fast Path.

The Fast Path represents the services component of your Lacerte program and is required as part of your software license. These services include:

- Individual network access1

- Year-round e-file

- Download from financial institutions

- U.S. based technical & product support

- Access to software downloads, training content, and data conversion services

Fast Path is automatically included as part of your Lacerte annual renewal.

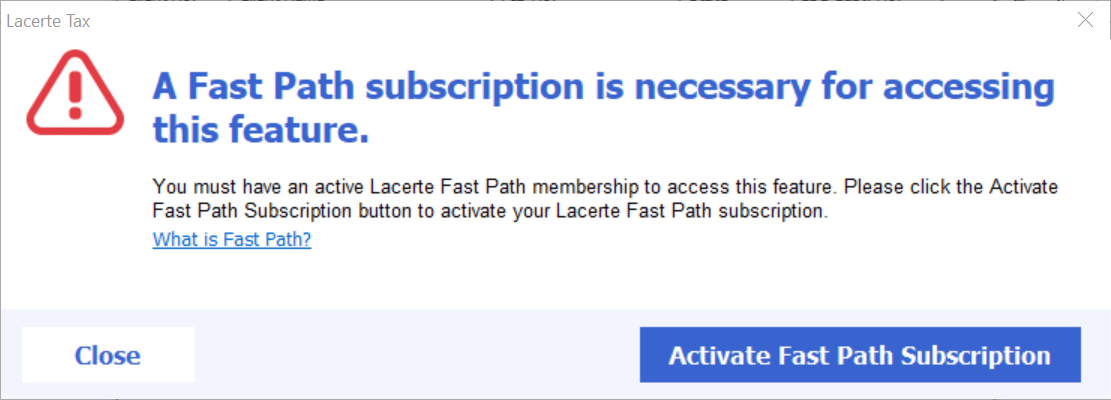

If you don't renew, you may see this error message:

Select Activate Fast Path Subscribtion to renew your Fast Path licence for the current tax year. You can continue to use Lacertefrom a prior year but you will need an updated Fast Path License for access to all services.

Without Fast Path, Lacerte will continue to work on your desktop, but you won't have access to certain services such as e-filing, support, or authorizing new returns for current or prior years if you're on a pay-as-you-go basis.

What do Fast Path services include?

- E-file for current year returns, late returns, and amended returns

- Pay-per-return (REP) access for current and prior tax years

- Live, U.S. based technical & product support

- Concurrent network access by multiple users

- Downloads for all tax software programs from My Account

- Access to training content

- Access to Lacerte E-Organizer

- Federal interest rate updates

- Electronic signatures for Benefit Plan returns (5500)

- Transaction downloads from financial institutions (such as banks and payroll processors)

- Data conversion services

- Intuit Link

- Access to Intuit eSignature (envelopes purchased separately)

When is my Fast Path active?

The Fast Path service period is the calendar year. For example, the Fast Path included in your Lacerte Tax 2023 purchase will give you access to these services from January 1, 2024, to December 31, 2024. If you renew by December 31 each year, you won't experience any interruption of services.

Do I need to have Fast Path?

Yes. A Fast Path will always automatically be included in your Lacertepurchase or renewal as it is required for each software license.

Without Fast Path, you'll still be able to use your program to prepare and file paper returns for any unlimited modules purchased that have already been authorized. Any new returns will require a current year fast path.

Network users should purchase additional Fast Path seats to allow concurrent program access for multiple users.

Why did Lacerte separate Fast Path services from the program?

Before 2014, we delivered the tax year program that was used to e-file returns from January to October, at which time we stopped supporting that year's program.

With the introduction of multi-year e-filing, our prior year programs could be used to e-file for up to three years, and required year-round support. The Fast Path was introduced to bundle several items that may have been billed separately in prior years and had varying service periods, like the REP License, Network License, or e-file fees.

Based on customer feedback, we're updating our service periods to support renewed customers with the services they need.

What if I haven't renewed Lacerte for the current tax year?

You'll be able to use your program to prepare and file paper returns for any unlimited modules you've purchased that have already been authorized. If you don't renew your program, you'll lose access to Fast Path services, including PPR access, e-filing capability, live support, and program updates.

1 Licensed per user